=================================

日常会話で役立つ「Make」の用法(中級編)

=================================

先日のコラム『日常会話をよりスムーズにする「Make」の用法35選(https://hapaeikaiwa.com/?p=23243)』では、makeを使った35のフレーズをご紹介しましたが、今回はmakeを使った日常表現「中級者編」をご紹介します。

--------------------------------------------------

1) Make out

--------------------------------------------------

Make out は「見える」や「聞こえる」、「読める」など何かを認識したり、理解することを意味します。例えば、友達に「あの標識なんて書いてあるか見える?」と聞く場合は「Can you make out that sign?」、その質問に対して「遠すぎて見えないよ」と返事をする場合は「It’s too far. I can’t make it out.」と言います。この表現は一般的に、「〜が見えない」や「〜が判読できない」のように、否定形で使われます。

その他、make out は「イチャイチャする」を意味するスラングとしても使われます。この表現にはディープキスをする意味合いもあり、特にパーティーでカップルがイチャついているのを見たときに、「Omg. Tom and Lisa are making out!(うわ!トムとリサがイチャイチャしている)」のように使われます。なお、キス以上の行為はmake outには含まれません。

<例文>

What does that sign say? Can you make it out?

(あの標識なんて書いてある?読める?)

I couldn’t make out what he said. Did you catch it?

(彼が言ったこと聞こえなかったよ。彼がなんて言ったか理解できた?)

I heard Peter and Megan were making out at the party last night.

(昨晩、ピーターとメーガンはパーティーでイチャついていたらしいよ)

--------------------------------------------------

2) Make it quick

--------------------------------------------------

Make it quickは直訳すると「早く作ってね」になりますが、日常会話では急いでいるときに相手に対して「早く済ませてね」や「急いでね」の意味で使われる話し言葉です。使い方はhurry upと似ており、例えば電車が出発する間際に友達が「I have go to the bathroom.(トイレに行かないと)」と言ったときに、「Make it quick. The train is leaving in 5 minutes.(急いでね。電車は5分で出発するから)」という具合に命令形で使われることが多いです。「すぐに済ませるから」は「I’ll make it quick.」と言います。

<例文>

〜会話例1〜

A: Do I have time to get changed?

(着替える時間はある?)

B: Yeah, but make it quick. The show is starting in 20 minutes.

(ええ、でも急いでね。ショーは20分で始まるから)

〜会話例2〜

A: Do you have a minute? I know you’re busy. I’ll make it quick.

(ちょっといいですか?忙しいのは分かっているので、すぐに済ませます)

B: Yeah, what’s up?

(ええ、どうしました?)

--------------------------------------------------

3) Make sense

--------------------------------------------------

Make sense は物事を理解したときに使われ、分からなかったことが明らかになったり、何かに納得したことを表します。I understand と意味は似ていますが、make sense は話にしっかり筋が通っていて理解できるニュアンスがあり、「分かりましたか?」は「Does it make sense?」、「ええ、理解できました」は「Yeah, that makes sense.」と言います。逆に、話が矛盾していたり、筋が通っていなかったり、理屈がおかしい時は、「It doesn’t make sense.」と言います。

<例文>

That makes sense. Thanks for the clarification.

(納得しました。説明ありがとうございました)

That makes sense. No wonder he was so upset.

(なるほどね。どおりで彼はあんなに腹を立てていたんだ)

What she’s saying doesn’t make sense. She’s contradicting herself.

(彼女が言っていることは筋が通っていません。矛盾したことを言っている)

--------------------------------------------------

4) Make up

--------------------------------------------------

この表現は、喧嘩をした相手と仲直りすることや、もめ事を丸く収めることを表し、喧嘩をした友達同士やカップルが仲直りする状況で使われます。例えば、「私はジョンと仲直りした」は「I made up with John.」、「マイクとマヤは仲直りした」は「Mike and Maya made up.」という具合に使われます。ちなみに、make up は「埋め合わせをする」を意味し、例えば、彼女の誕生日をうっかり忘れてしまい「ごめん。埋め合わせするから」と言いたい時は「I’m sorry. I’ll make it up to you.」と表現します。

その他、make upは歌や詩、ストーリーなどを自作する意味としても使われます。例えば、「歌を作りました」は「I made up a song.」、「詩を作りました」は「I made up a poem.」のように表します。

<例文>

They’re on good terms now. They made up with each other.

(彼らは仲直りしたので、今は仲良くしています)

I got into an argument with Matt but we made up.

(私はマットと喧嘩しましたが、仲直りしました)

I’m sorry about last night. I’ll make it up to you.

(昨日の夜はごめん。埋め合わせするから)

Wow, did you make up that song on the spot?

(すごい、その曲、即興で作ったの?)

--------------------------------------------------

5) Make a difference

--------------------------------------------------

Make a differenceを直訳すると「違いを作る」ですが、この表現は、ある行動によってポジティブな変化や結果が生まれることを意味します。例えば、「留学経験が英会話力に大きな影響を与えた」と表現する場合は「Studying abroad really made a difference」と言うことができます。逆に、効果やインパクトがない場合は、「It makes no difference.」または「It doesn’t make any difference.」と表現します。

その他、It makes no differenceは「どっちいでもいい」を意味し、特に、選択肢が2つある状況でどちらを選択しても気にしないといったニュアンスが含まれます。

<例文>

Writing down your goals really makes a difference. You should try it.

(目標を書き出すと効果あるから。やってみな)

A lot of people don’t vote because they think it makes no difference.

(多くの人は投票しても意味がないと思っているので投票しません)

I can do Korean food or Japanese food. It doesn’t make a difference to me.

(韓国料理でも日本食でも、どっちでもいいよ)

--------------------------------------------------

6) What do you make of

--------------------------------------------------

What do you make of ____ は相手の意見や考えを尋ねるときに使われ、 What do you think of ____ の言い換え表現として使われます。例えば、「これどう思う?」は「What do you make of this?」、「あの映画についてどう思う?」は「What do you make of that movie?」という具合に使われます。その他、相手がある物事をどのように解釈するのかを尋ねるときにも使われ、例えば、不可解なメッセージが届いたときに「What do you make of this message?(このメッセージをあなたはどう解釈しますか?)」と表現します。

<例文>

What do you make of the idea she proposed?

(彼女が提案したアイデアについてどう思いますか?)

Tony sent me a weird email. Take a look at it. What do you make of it?

(トニーから変なメールが届いたんだけど、ちょっと見てみて。どう思う?)

I don’t know what to make of him. But there’s something about him that seems shady.

(彼についてどう思うか分かりません。でも、なぜだか分からないけど怪しい感じがするんだよね)

--------------------------------------------------

7) Make a wish

--------------------------------------------------

Make a wish は「願い事をする」を意味します。例えば、誕生日パーティーの主役に「ろうそくを吹き消して願い事を言って」と言いたい場合は「Blow out the candles and make a wish.」と言います。その他、「欲しいものリストを作る」は「Make a wish list.」と言います。

<例文>

Happy birthday! Did you make a wish?

(お誕生日おめでとう。願い事をした?)

It’s 11:11. Make a wish guys!

(11時11分だよ。願い事をして!)

I made my Amazon wish list and emailed it to you.

(Amazonの欲しいものリストを作ってメールしたよ)

--------------------------------------------------

8) Make fun of

--------------------------------------------------

Make fun ofは人をからかったり、馬鹿にしたりすることを表します。相手をからかって本当に困らせる時と友達同士が冗談でからかい合う時、両方の状況で使えます。「彼は彼女をからかった」と言いたい場合は「He made fun of her.」と言い、made fun of の後にからかう対象が入ります。

<例文>

I've known him since I was a kid. We make fun of each other all the time.

(彼とは幼なじみで、いつもお互いをからかい合います)

She's upset because Jack made fun of her pronunciation.

(ジャックは彼女の発音を馬鹿にしたので、彼女は腹を立てています)

My friends always make fun of me because I can't eat hot food.

(私は猫舌だから、いつも友達にからかわれるんだ)

--------------------------------------------------

9) Make up one’s mind

--------------------------------------------------

Make up one’s mind は「決める」や「決心する」を意味し、decideのより口語的な言い方です。どうしていいか分からない時や、優柔不断でなかなか決断できない状況でよく使われ、優柔不断な友達に対して「決めて!はっきりして!」と言う場合は「Make up your mind!」、そして「どうしていいか分からないよ。迷う!」と返事する場合は「I can’t make up my mind!」と言います。

<例文>

Did you make up your mind or are you still thinking about it?

(決まった?それともまだどうするか考えているの?)

I don’t know what to do. I can’t make up my mind.

(どうしていいか分からないよ。迷うな)

I made up my mind. I’m going to quit my job and start my own business.

(決心しました。仕事を辞めて自分のビジネスを始めます)

--------------------------------------------------

10) Make one’s day

--------------------------------------------------

誰かのおかげで幸せな気分になったり、相手の一言で励まされたとき英語では「You made my day.」という表現を使うことがよくあります。直訳すると「あなたのおかげで良い一日になったよ」になり、相手に感謝の気持ちを伝えるときに使われ、「Thanks. You made my day!」のようにセットで使われます。その他、試験に合格したり、面接に受かったりなど、良い報告を受けたり嬉しい出来事があったときは「That made my day!」と言います。ちなみに、dayだけではなく「That made my week」、「That made my month.」、「That made my year」と言うこともできます。

<例文>

Thanks for the gifts. You made my day.

(プレゼントありがとう。おかげで最高の1日になったよ)

Thank you for the call. You really made my day.

(電話してくれてありがとう。おかげで最高の1日になったよ)

I just found out I got into the MBA program. I'm so excited! That made my year!

(MBAプログラムに入れることが分かったよ。めっちゃ嬉しい!今年最高のニュースだ!)

ブログ記事URL:https://hapaeikaiwa.com/?p=23259

~~~~~~~~~~~~~~~~~~~

無料メルマガ『1日1フレーズ!生英語』配信中!

通勤・通学などのちょとした合間を利用して英語が学べるメルマガ『1日1フレーズ!生英語』を平日の毎朝6時に配信中!ただ単にフレーズを紹介しているだけではなく、音声を使った学習プロセスが組み込まれているので、メルマガを読むこと自体が学習方法!

https://hapaeikaiwa.com/mailmagazine/

~~~~~~~~~~~~~~~~~~~

同時也有27部Youtube影片,追蹤數超過5萬的網紅Brenda Tan,也在其Youtube影片中提到,HOPE IM NOT TOO LATE! xoxoxo ⇩ OPEN ME FOR FUN AND GAMES ☞ The jewellery I have on gomargaux.net @gomargaux on instagram ☞ Skillshare https://sk...

「an idea catch on」的推薦目錄:

- 關於an idea catch on 在 Hapa Eikaiwa Facebook 的最佳解答

- 關於an idea catch on 在 Taipei Ethereum Meetup Facebook 的最讚貼文

- 關於an idea catch on 在 慧惠 Wai Wai Facebook 的最佳解答

- 關於an idea catch on 在 Brenda Tan Youtube 的最佳貼文

- 關於an idea catch on 在 Brenda Tan Youtube 的最佳貼文

- 關於an idea catch on 在 Rayner Teo Youtube 的最佳貼文

- 關於an idea catch on 在 Jonah Berger - Contagious: Why Things Catch On - YouTube 的評價

an idea catch on 在 Taipei Ethereum Meetup Facebook 的最讚貼文

📜 [專欄新文章] Uniswap v3 Features Explained in Depth

✍️ 田少谷 Shao

📥 歡迎投稿: https://medium.com/taipei-ethereum-meetup #徵技術分享文 #使用心得 #教學文 #medium

Once again the game-changing DEX 🦄 👑

Image source: https://uniswap.org/blog/uniswap-v3/

Outline

0. Intro1. Uniswap & AMM recap2. Ticks 3. Concentrated liquidity4. Range orders: reversible limit orders5. Impacts of v36. Conclusion

0. Intro

The announcement of Uniswap v3 is no doubt one of the most exciting news in the DeFi place recently 🔥🔥🔥

While most have talked about the impact v3 can potentially bring on the market, seldom explain the delicate implementation techniques to realize all those amazing features, such as concentrated liquidity, limit-order-like range orders, etc.

Since I’ve covered Uniswap v1 & v2 (if you happen to know Mandarin, here are v1 & v2), there’s no reason for me to not cover v3 as well ✅

Thus, this article aims to guide readers through Uniswap v3, based on their official whitepaper and examples made on the announcement page. However, one needs not to be an engineer, as not many codes are involved, nor a math major, as the math involved is definitely taught in your high school, to fully understand the following content 😊😊😊

If you really make it through but still don’t get shxt, feedbacks are welcomed! 🙏

There should be another article focusing on the codebase, so stay tuned and let’s get started with some background noise!

1. Uniswap & AMM recap

Before diving in, we have to first recap the uniqueness of Uniswap and compare it to traditional order book exchanges.

Uniswap v1 & v2 are a kind of AMMs (automated market marker) that follow the constant product equation x * y = k, with x & y stand for the amount of two tokens X and Y in a pool and k as a constant.

Comparing to order book exchanges, AMMs, such as the previous versions of Uniswap, offer quite a distinct user experience:

AMMs have pricing functions that offer the price for the two tokens, which make their users always price takers, while users of order book exchanges can be both makers or takers.

Uniswap as well as most AMMs have infinite liquidity¹, while order book exchanges don’t. The liquidity of Uniswap v1 & v2 is provided throughout the price range [0,∞]².

Uniswap as well as most AMMs have price slippage³ and it’s due to the pricing function, while there isn’t always price slippage on order book exchanges as long as an order is fulfilled within one tick.

In an order book, each price (whether in green or red) is a tick. Image source: https://ftx.com/trade/BTC-PERP

¹ though the price gets worse over time; AMM of constant sum such as mStable does not have infinite liquidity

² the range is in fact [-∞,∞], while a price in most cases won’t be negative

³ AMM of constant sum does not have price slippage

2. Tick

The whole innovation of Uniswap v3 starts from ticks.

For those unfamiliar with what is a tick:

Source: https://www.investopedia.com/terms/t/tick.asp

By slicing the price range [0,∞] into numerous granular ticks, trading on v3 is highly similar to trading on order book exchanges, with only three differences:

The price range of each tick is predefined by the system instead of being proposed by users.

Trades that happen within a tick still follows the pricing function of the AMM, while the equation has to be updated once the price crosses the tick.

Orders can be executed with any price within the price range, instead of being fulfilled at the same one price on order book exchanges.

With the tick design, Uniswap v3 possesses most of the merits of both AMM and an order book exchange! 💯💯💯

So, how is the price range of a tick decided?

This question is actually somewhat related to the tick explanation above: the minimum tick size for stocks trading above 1$ is one cent.

The underlying meaning of a tick size traditionally being one cent is that one cent (1% of 1$) is the basis point of price changes between ticks, ex: 1.02 — 1.01 = 0.1.

Uniswap v3 employs a similar idea: compared to the previous/next price, the price change should always be 0.01% = 1 basis point.

However, notice the difference is that in the traditional basis point, the price change is defined with subtraction, while here in Uniswap it’s division.

This is how price ranges of ticks are decided⁴:

Image source: https://uniswap.org/whitepaper-v3.pdf

With the above equation, the tick/price range can be recorded in the index form [i, i+1], instead of some crazy numbers such as 1.0001¹⁰⁰ = 1.0100496621.

As each price is the multiplication of 1.0001 of the previous price, the price change is always 1.0001 — 1 = 0.0001 = 0.01%.

For example, when i=1, p(1) = 1.0001; when i=2, p(2) = 1.00020001.

p(2) / p(1) = 1.00020001 / 1.0001 = 1.0001

See the connection between the traditional basis point 1 cent (=1% of 1$) and Uniswap v3’s basis point 0.01%?

Image source: https://tenor.com/view/coin-master-cool-gif-19748052

But sir, are prices really granular enough? There are many shitcoins with prices less than 0.000001$. Will such prices be covered as well?

Price range: max & min

To know if an extremely small price is covered or not, we have to figure out the max & min price range of v3 by looking into the spec: there is a int24 tick state variable in UniswapV3Pool.sol.

Image source: https://uniswap.org/whitepaper-v3.pdf

The reason for a signed integer int instead of an uint is that negative power represents prices less than 1 but greater than 0.

24 bits can cover the range between 1.0001 ^ (2²³ — 1) and 1.0001 ^ -(2)²³. Even Google cannot calculate such numbers, so allow me to offer smaller values to have a rough idea of the whole price range:

1.0001 ^ (2¹⁸) = 242,214,459,604.341

1.0001 ^ -(2¹⁷) = 0.000002031888943

I think it’s safe to say that with a int24 the range can cover > 99.99% of the prices of all assets in the universe 👌

⁴ For implementation concern, however, a square root is added to both sides of the equation.

How about finding out which tick does a price belong to?

Tick index from price

The answer to this question is rather easy, as we know that p(i) = 1.0001^i, simply takes a log with base 1.0001 on both sides of the equation⁴:

Image source: https://www.codecogs.com/latex/eqneditor.php

Let’s try this out, say we wanna find out the tick index of 1000000.

Image source: https://ncalculators.com/number-conversion/log-logarithm-calculator.htm

Now, 1.0001¹³⁸¹⁶² = 999,998.678087146. Voila!

⁵ This formula is also slightly modified to fit the real implementation usage.

3. Concentrated liquidity

Now that we know how ticks and price ranges are decided, let’s talk about how orders are executed in a tick, what is concentrated liquidity and how it enables v3 to compete with stablecoin-specialized DEXs (decentralized exchange), such as Curve, by improving the capital efficiency.

Concentrated liquidity means LPs (liquidity providers) can provide liquidity to any price range/tick at their wish, which causes the liquidity to be imbalanced in ticks.

As each tick has a different liquidity depth, the corresponding pricing function x * y = k also won’t be the same!

Each tick has its own liquidity depth. Image source: https://uniswap.org/blog/uniswap-v3/

Mmm… examples are always helpful for abstract descriptions 😂

Say the original pricing function is 100(x) * 1000(y) = 100000(k), with the price of X token 1000 / 100 = 10 and we’re now in the price range [9.08, 11.08].

If the liquidity of the price range [11.08, 13.08] is the same as [9.08, 11.08], we don’t have to modify the pricing function if the price goes from 10 to 11.08, which is the boundary between two ticks.

The price of X is 1052.63 / 95 = 11.08 when the equation is 1052.63 * 95 = 100000.

However, if the liquidity of the price range [11.08, 13.08] is two times that of the current range [9.08, 11.08], balances of x and y should be doubled, which makes the equation become 2105.26 * 220 = 400000, which is (1052.63 * 2) * (110 * 2) = (100000 * 2 * 2).

We can observe the following two points from the above example:

Trades always follow the pricing function x * y = k, while once the price crosses the current price range/tick, the liquidity/equation has to be updated.

√(x * y) = √k = L is how we represent the liquidity, as I say the liquidity of x * y = 400000 is two times the liquidity of x * y = 100000, as √(400000 / 100000) = 2.

What’s more, compared to liquidity on v1 & v2 is always spread across [0,∞], liquidity on v3 can be concentrated within certain price ranges and thus results in higher capital efficiency from traders’ swapping fees!

Let’s say if I provide liquidity in the range [1200, 2800], the capital efficiency will then be 4.24x higher than v2 with the range [0,∞] 😮😮😮 There’s a capital efficiency comparison calculator, make sure to try it out!

Image source: https://uniswap.org/blog/uniswap-v3/

It’s worth noticing that the concept of concentrated liquidity was proposed and already implemented by Kyper, prior to Uniswap, which is called Automated Price Reserve in their case.⁵

⁶ Thanks to Yenwen Feng for the information.

4. Range orders: reversible limit orders

As explained in the above section, LPs of v3 can provide liquidity to any price range/tick at their wish. Depending on the current price and the targeted price range, there are three scenarios:

current price < the targeted price range

current price > the targeted price range

current price belongs to the targeted price range

The first two scenarios are called range orders. They have unique characteristics and are essentially fee-earning reversible limit orders, which will be explained later.

The last case is the exact same liquidity providing mechanism as the previous versions: LPs provide liquidity in both tokens of the same value (= amount * price).

There’s also an identical product to the case: grid trading, a very powerful investment tool for a time of consolidation. Dunno what’s grid trading? Check out Binance’s explanation on this, as this topic won’t be covered!

In fact, LPs of Uniswap v1 & v2 are grid trading with a range of [0,∞] and the entry price as the baseline.

Range orders

To understand range orders, we’d have to first revisit how price is discovered on Uniswap with the equation x * y = k, for x & y stand for the amount of two tokens X and Y and k as a constant.

The price of X compared to Y is y / x, which means how many Y one can get for 1 unit of X, and vice versa the price of Y compared to X is x / y.

For the price of X to go up, y has to increase and x decrease.

With this pricing mechanism in mind, it’s example time!

Say an LP plans to place liquidity in the price range [15.625, 17.313], higher than the current price of X 10, when 100(x) * 1000(y) = 100000(k).

The price of X is 1250 / 80 = 15.625 when the equation is 80 * 1250 = 100000.

The price of X is 1315.789 / 76 = 17.313 when the equation is 76 * 1315.789 = 100000.

If now the price of X reaches 15.625, the only way for the price of X to go even higher is to further increase y and decrease x, which means exchanging a certain amount of X for Y.

Thus, to provide liquidity in the range [15.625, 17.313], an LP needs only to prepare 80 — 76 = 4 of X. If the price exceeds 17.313, all 4 X of the LP is swapped into 1315.789 — 1250 = 65.798 Y, and then the LP has nothing more to do with the pool, as his/her liquidity is drained.

What if the price stays in the range? It’s exactly what LPs would love to see, as they can earn swapping fees for all transactions in the range! Also, the balance of X will swing between [76, 80] and the balance of Y between [1250, 1315.789].

This might not be obvious, but the example above shows an interesting insight: if the liquidity of one token is provided, only when the token becomes more valuable will it be exchanged for the less valuable one.

…wut? 🤔

Remember that if 4 X is provided within [15.625, 17.313], only when the price of X goes up from 15.625 to 17.313 is 4 X gradually swapped into Y, the less valuable one!

What if the price of X drops back immediately after reaching 17.313? As X becomes less valuable, others are going to exchange Y for X.

The below image illustrates the scenario of DAI/USDC pair with a price range of [1.001, 1.002] well: the pool is always composed entirely of one token on both sides of the tick, while in the middle 1.001499⁶ is of both tokens.

Image source: https://uniswap.org/blog/uniswap-v3/

Similarly, to provide liquidity in a price range < current price, an LP has to prepare a certain amount of Y for others to exchange Y for X within the range.

To wrap up such an interesting feature, we know that:

Only one token is required for range orders.

Only when the current price is within the range of the range order can LP earn trading fees. This is the main reason why most people believe LPs of v3 have to monitor the price more actively to maximize their income, which also means that LPs of v3 have become arbitrageurs 🤯

I will be discussing more the impacts of v3 in 5. Impacts of v3.

⁷ 1.001499988 = √(1.0001 * 1.0002) is the geometric mean of 1.0001 and 1.0002. The implication is that the geometric mean of two prices is the average execution price within the range of the two prices.

Reversible limit orders

As the example in the last section demonstrates, if there is 4 X in range [15.625, 17.313], the 4 X will be completely converted into 65.798 Y when the price goes over 17.313.

We all know that a price can stay in a wide range such as [10, 11] for quite some time, while it’s unlikely so in a narrow range such as [15.625, 15.626].

Thus, if an LP provides liquidity in [15.625, 15.626], we can expect that once the price of X goes over 15.625 and immediately also 15.626, and does not drop back, all X are then forever converted into Y.

The concept of having a targeted price and the order will be executed after the price is crossed is exactly the concept of limit orders! The only difference is that if the range of a range order is not narrow enough, it’s highly possible that the conversion of tokens will be reverted once the price falls back to the range.

As price ranges follow the equation p(i) = 1.0001 ^ i, the range can be quite narrow and a range order can thus effectively serve as a limit order:

When i = 27490, 1.0001²⁷⁴⁹⁰ = 15.6248.⁸

When i = 27491, 1.0001²⁷⁴⁹¹ = 15.6264.⁸

A range of 0.0016 is not THAT narrow but can certainly satisfy most limit order use cases!

⁸ As mentioned previously in note #4, there is a square root in the equation of the price and index, thus the numbers here are for explantion only.

5. Impacts of v3

Higher capital efficiency, LPs become arbitrageurs… as v3 has made tons of radical changes, I’d like to summarize my personal takes of the impacts of v3:

Higher capital efficiency makes one of the most frequently considered indices in DeFi: TVL, total value locked, becomes less meaningful, as 1$ on Uniswap v3 might have the same effect as 100$ or even 2000$ on v2.

The ease of spot exchanging between spot exchanges used to be a huge advantage of spot markets over derivative markets. As LPs will take up the role of arbitrageurs and arbitraging is more likely to happen on v3 itself other than between DEXs, this gap is narrowed … to what extent? No idea though.

LP strategies and the aggregation of NFT of Uniswap v3 liquidity token are becoming the blue ocean for new DeFi startups: see Visor and Lixir. In fact, this might be the turning point for both DeFi and NFT: the two main reasons of blockchain going mainstream now come to the alignment of interest: solving the $$ problem 😏😏😏

In the right venue, which means a place where transaction fees are low enough, such as Optimism, we might see Algo trading firms coming in to share the market of designing LP strategies on Uniswap v3, as I believe Algo trading is way stronger than on-chain strategies or DAO voting to add liquidity that sort of thing.

After reading this article by Parsec.finance: The Dex to Rule Them All, I cannot help but wonder: maybe there is going to be centralized crypto exchanges adopting v3’s approach. The reason is that since orders of LPs in the same tick are executed pro-rata, the endless front-running speeding-competition issue in the Algo trading world, to some degree, is… solved? 🤔

Anyway, personal opinions can be biased and seriously wrong 🙈 I’m merely throwing out a sprat to catch a whale. Having a different voice? Leave your comment down below!

6. Conclusion

That was kinda tough, isn’t it? Glad you make it through here 🥂🥂🥂

There are actually many more details and also a huge section of Oracle yet to be covered. However, since this article is more about features and targeting normal DeFi users, I’ll leave those to the next one; hope there is one 😅

If you have any doubt or find any mistake, please feel free to reach out to me and I’d try to reply AFAP!

Stay tuned and in the meantime let’s wait and see how Uniswap v3 is again pioneering the innovation of DeFi 🌟

Uniswap v3 Features Explained in Depth was originally published in Taipei Ethereum Meetup on Medium, where people are continuing the conversation by highlighting and responding to this story.

👏 歡迎轉載分享鼓掌

an idea catch on 在 慧惠 Wai Wai Facebook 的最佳解答

It’s exciting to see my illustration “Bing Sutt” getting featured at the HKAGA x Ferragamo Collaboration. Thank you Galerie KOO Hong Kong Art Gallery Association and Salvatore Ferragamo for giving me the chance to share my memories about Bing Sutt.

-Artworks on Gancini Bing Sutt Truck-

Wai Wai @waiwai.sketches

Bing Sutt, 2020

Watercolour (print only)

Framed to 40 x 40 cm

Represented by Galerie Koo

Submitted through an open call for Hong Kong artists organised by HKAGA, the works displayed in the truck all allude to the city’s culture, echoing the historical facet of Sheung Wan, a district dotted with bing sutts in the 50s to 60s where one can still catch a glimpse of the old Hong Kong amidst the antique and dried seafood shops that line its streets.

Wai Wai paints illustrations of local vintage shops to bring people closer in their communities. Portrait drawing is her favourite subject, and by conveying the idea of diligence and dedication in work through her drawings made her feel fulfilled all the time. Wai Wai’s "A Love Letter to Yau Ma Tei" is her first solo album dedicating her love for Yau Ma Tei, as she was brought up in the area.

-Find the Gancini Bing Sutt Truck-

March 13 11:00 – 19:00 Man Mo Temple (Hollywood Road) *Treasure Hunt

March 14 11:00 – 19:00 Man Mo Temple (Hollywood Road) *Treasure Hunt

March 15 11:00 – 19:00 Queen’s Road Central

March 16 11:00 – 19:00 Queen’s Road Central

March 17 11:00 – 19:00 Harbour City Pier 3 Parking

March 18 11:00 – 19:00 Harbour City Pier 3 Parking

an idea catch on 在 Brenda Tan Youtube 的最佳貼文

HOPE IM NOT TOO LATE!

xoxoxo

⇩ OPEN ME FOR FUN AND GAMES

☞ The jewellery I have on

gomargaux.net

@gomargaux on instagram

☞ Skillshare

https://skl.sh/2MseB5m

» CATCH THESE TOO

APARTMENT TOUR

☞ https://youtu.be/2dUI-UG94pI

USE SINGAPOREAN TINDER WITH ME

☞ https://youtu.be/2FHHvKHyvG4

HOW I CAN AFFORD LIVING ALONE

☞ https://youtu.be/11ubIEvi8uM

» DON'T BE A STRANGER

☞ IG - http://instagram.com/wordweed

☞ BLOG - http://wordweed.blogspot.sg

☞ TWEET TWEET - http://twitter.com/wordweed

☞ FB - fb.me/thewordweed

» I also run an online store for vintage and contemporary jewellery sourced worldwide that I personally source, curate and shoot.

☞ gomargaux.net

☞ @gomargaux on instagram

» BUSINESS INQUIRIES/OPPORTUNITIES

✎ wordweed@gmail.com

▻ Music ◅

first date

an idea catch on 在 Brenda Tan Youtube 的最佳貼文

SIGN UPS FOR THE GRAB BAGS ARE FULL!

I had to pull more clothes from the closet and makeup from my drawers to fill up the bags because I had no idea this was gonna be such a big hit. Thank you so much for the support! For those who signed up, I hope you like them hehe I really spent time making sure it'll be up your alley. For those who didn't manage to get one this time round, don't worry I'm sure we'll have to do this again sometime next year HAHAHA

⇩ OPEN ME FOR GOOD STUFF

Makeup: 1:33

Skincare: 12:35

Clothes: 18:56

☞ Sign up for a grab bag here!

FULL SORRY!!

☞ The jewellery I have on

Ears: Frances

Neck: Faye

on gomargaux.net \ @gomargaux on instagram

» CATCH THESE TOO

VLOGMAS

☞ https://www.youtube.com/playlist?list=PLQjZw5Aco9OHv4_gO2SLdnglhmabjNwyH

HOW I CAN AFFORD LIVING ALONE

☞ https://youtu.be/11ubIEvi8uM

BUJO FLIP THRU & SET UP

☞ https://youtu.be/RGmJBuykCMw

-

Hello, I'm Brenda - very artsy, a lil fartsy and always keen on creating good content.

DON'T BE A STRANGER

☞ IG - http://instagram.com/wordweed

☞ BLOG - http://wordweed.blogspot.sg

☞ TWEET TWEET - http://twitter.com/wordweed

☞ FB - fb.me/thewordweed

» I also run an online store for vintage jewellery sourced worldwide that I personally source, curate and shoot.

☞ gomargaux.net

☞ @gomargaux on instagram

» BUSINESS INQUIRIES/OPPORTUNITIES

✎ wordweed@gmail.com

▻ Music ◅

birocratic - blue hour

an idea catch on 在 Rayner Teo Youtube 的最佳貼文

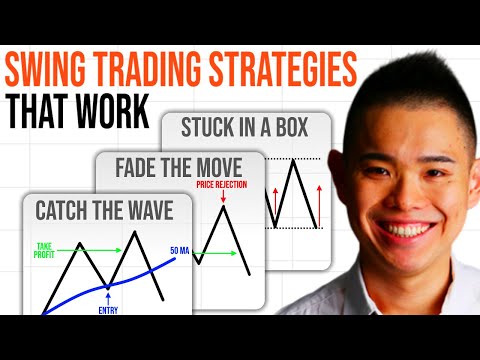

Discover 3 swing trading strategies that work so you can profit in bull & bear markets.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: http://priceactiontradingsecrets.com/

0:10 Doesn't matter whether you're trading Forex, stocks, whatever, right? These strategies can be applied the same. So are you ready? Then let's begin. Okay, now, before I begin, right, I want to explain to you what is swing trading because some of you are wondering here Rayner, what is swing trading, alright? So let me explain to you quickly. So swing trading, the idea is to capture one swing in the market.

2:10 Swing Trading Strategy #1: Stuck In A Box

The first one is what I call stuck in a box, where the price is pretty much stuck in a range, stuck in a box, similar to what you've seen earlier. So this the core idea here is that the market is in a range, you want to buy low and sell high, so how you go about doing it is to let the price come into an area of value, an area of support, okay?

4:14 Swing Trading Strategy #2: Catch The Wave

So the other one is what I call catch the wave. So this is used when the market is in an uptrend. When the market is trending, you are trying to time your entry and capture just one swing in an uptrend.

6:18 Swing Trading Strategy #3: Fade The Move

So it's what I call fade the move. So this is a counter-trend trade. So because when the market is trending and if it has traveled quite a long, a distance towards the swings high, towards resistance, there is opportunity for you to take a counter trend trade but I'll share with you a little bit of how to manage this type of trade.

If you want to learn more about what I do, you can go down to my website over here, tradingwithrayner.com, tradingwithrayner.com, Rayner is my name, you should know that. And you can scroll down a little bit and have a couple of trading guides over here. So one is called The Ultimate Guide to Trend Following where I share with you practical trading techniques on how to ride big trends in the market. And then The Ultimate Price Action, The Ultimate Guide to Price Action Trading on How to Better Time Your Entries and Exits. These two guides, completely free, click the blue button. And I'll send it to your email address. For free. So with that said, I've come to the end of this video, I hope you find insightful. If you did, could you please hit the like button, and subscribe to my YouTube channel. And if there's anything to ask me or any questions, leave it in the comments section below. And I'll do my best to help. With that said, I'll talk to you soon.

** FREE TRADING STRATEGY GUIDES **

The Ultimate Guide to Price Action Trading: https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

The Monster Guide to Candlestick Patterns: https://www.tradingwithrayner.com/candlestick-pdf-guide/

** PREMIUM TRAINING **

Pro Traders Edge: https://www.tradingwithrayner.com/pte/

Pullback Stock Trading System: https://pullbackstocktradingsystem.com/

Price Action Trading Secrets: https://priceactiontradingsecrets.com/

an idea catch on 在 Jonah Berger - Contagious: Why Things Catch On - YouTube 的推薦與評價

... <看更多>